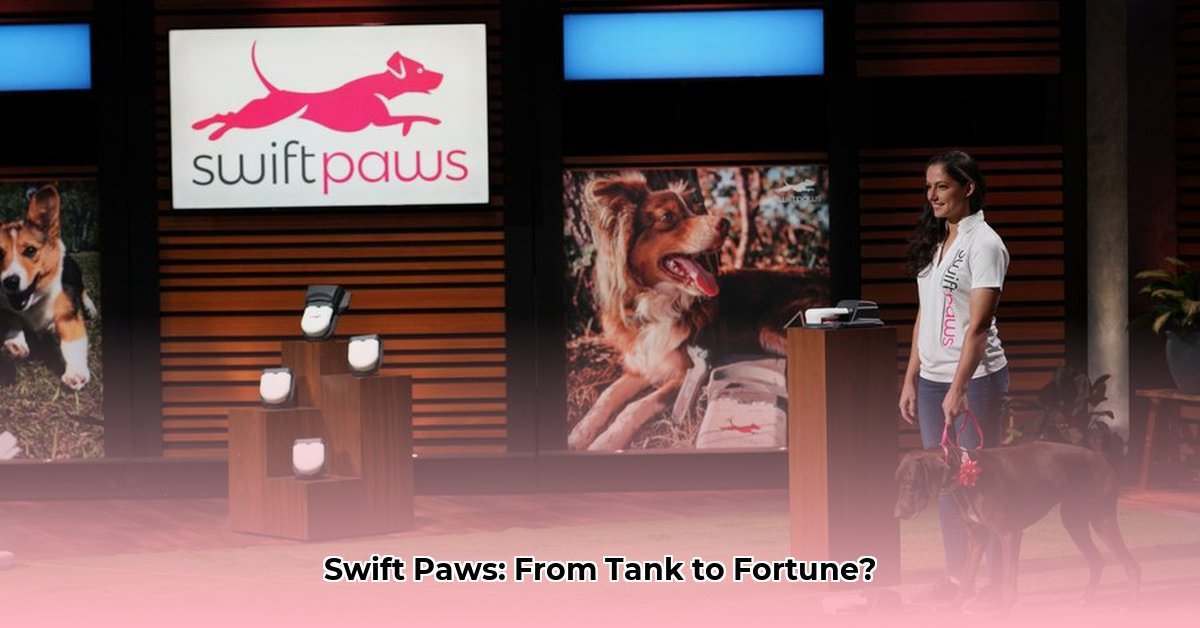

Swift Paws, the innovative dog training system, saw its net worth skyrocket following its appearance on Shark Tank. The show generated immediate buzz, resulting in a staggering $100,000 in sales within hours – a remarkable 7% of their total sales to that point. This wasn't a fleeting trend; sales exploded to over $2 million and 5,000 units sold. Lori Greiner's investment and mentorship, secured through her "Golden Ticket," proved instrumental in this success. Her business acumen guided Swift Paws through its rapid expansion, shaping their strategic direction. For more on Shark Tank success stories, check out this net worth analysis.

But the journey wasn't without its hurdles. The initial price point of over $400 presented a significant barrier to entry for many potential customers. This prompted Swift Paws to introduce the more affordable "Chase" model, priced between $199 and $299. Balancing profitability with accessibility remains a key challenge. High manufacturing costs directly impact pricing, raising the question: how can Swift Paws maintain quality and innovation while broadening its market reach?

To address this, Swift Paws diversified its offerings. Beyond the original lure-coursing system, they introduced pet accessories such as dog beds, food bowls, and flirt poles. The introduction of the more advanced "Home Plus" model also aims to capture a broader market segment and create multiple revenue streams. The long-term impact of this diversification strategy, however, remains to be seen. Will these new products resonate with consumers as successfully as the original? Only time will provide the definitive answer.

Several factors will significantly shape Swift Paws' future financial trajectory and net worth:

Cost Optimization: Streamlining manufacturing processes and exploring alternative suppliers are crucial for improving profit margins. This requires meticulous analysis of current operations and a willingness to embrace innovative solutions.

Market Expansion: Successfully tapping into new distribution channels and international markets is paramount for revenue growth. Strategic partnerships with retailers and online platforms, both domestically and globally, are key considerations.

Innovation: Swift Paws must continuously innovate and adapt to changing customer preferences and market trends to maintain its competitive edge. Investing in market research and incorporating customer feedback into product development are essential.

Strategic Alliances: Exploring strategic partnerships or acquisitions could provide advantages in manufacturing or distribution, strengthening the company's position in the market.

To assess Swift Paws' potential net worth, we must consider the inherent risks:

| Risk Category | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Production Costs | Medium | High | Optimize manufacturing, explore alternative suppliers, secure favorable pricing agreements. |

| Market Competition | Medium | Medium | Continuous innovation, targeted marketing, strong brand building. |

| Price Sensitivity | High | Medium | Balance price and perceived value, flexible pricing options, emphasize product quality. |

| Supply Chain Disruptions | Low | High | Diversify suppliers, strategic inventory management, contingency planning. |

Beyond the financial aspects, regulatory compliance is paramount. Swift Paws must ensure its products meet all safety and advertising standards, and safeguard its intellectual property. Addressing animal safety concerns is also essential for maintaining a positive brand image and avoiding potential legal issues. Successful navigation of the regulatory landscape is vital for long-term sustainable growth.

Determining Swift Paws' precise net worth proves challenging due to the interplay of various factors, including manufacturing costs, market competition, and consumer preferences. Continuous monitoring and adaptation are imperative for continued success. The company's ability to effectively mitigate risks and drive innovation will ultimately be the deciding factor in its long-term financial prospects. The company's post-Shark Tank growth, while impressive, underscores the dynamic nature of the market and the ongoing need for strategic adjustments.